Just How Bid Bonds Protect Service Providers and Ensure Task Stability

Just How Bid Bonds Protect Service Providers and Ensure Task Stability

Blog Article

Important Steps to Make Use Of and obtain Bid Bonds Successfully

Navigating the intricacies of bid bonds can substantially influence your success in protecting contracts. To approach this effectively, it's important to understand the basic steps involved, from collecting needed documentation to picking the appropriate surety copyright. The trip starts with arranging your financial declarations and a thorough portfolio of previous projects, which can demonstrate your integrity to possible sureties. Nonetheless, the real difficulty hinges on the meticulous option of a trusted company and the critical usage of the bid bond to boost your one-upmanship. What complies with is a better take a look at these important stages.

Understanding Bid Bonds

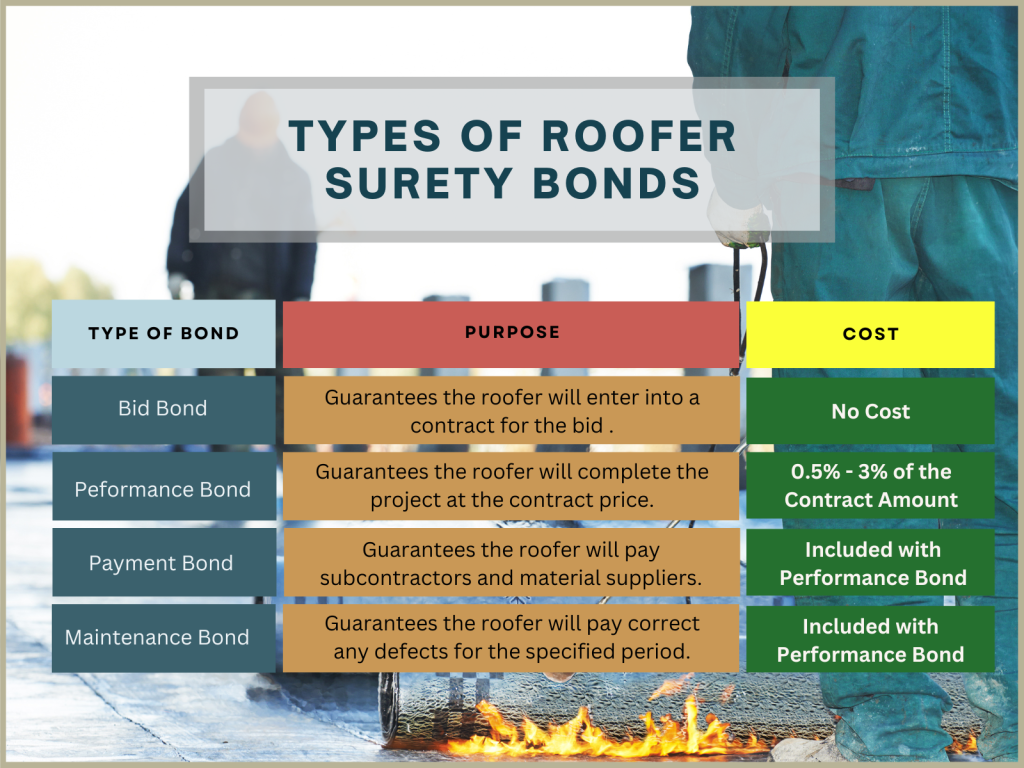

Quote bonds are a vital element in the construction and having market, offering as a financial assurance that a prospective buyer intends to participate in the agreement at the quote rate if awarded. Bid Bonds. These bonds minimize the risk for job proprietors, making sure that the selected specialist will certainly not only honor the proposal however likewise secure efficiency and payment bonds as required

Essentially, a proposal bond serves as a secure, securing the task owner against the monetary effects of a specialist stopping working or withdrawing a quote to commence the task after choice. Typically provided by a surety firm, the bond assurances settlement to the owner, typically 5-20% of the proposal quantity, ought to the specialist default.

In this context, quote bonds foster a much more credible and competitive bidding setting. They oblige contractors to existing realistic and major quotes, knowing that a financial fine looms over any type of violation of commitment. Moreover, these bonds make certain that just monetarily steady and credible contractors participate, as the extensive qualification process by surety business screens out much less reputable bidders. As a result, quote bonds play an essential role in keeping the stability and smooth procedure of the construction bidding process.

Planning For the Application

When planning for the application of a bid bond, meticulous company and detailed documentation are critical. A thorough testimonial of the project requirements and quote requirements is essential to ensure conformity with all terms. Begin by setting up all required monetary statements, consisting of balance sheets, income declarations, and capital declarations, to show your company's fiscal wellness. These records should be present and prepared by a certified accounting professional to enhance reputation.

Following, put together a listing of past jobs, particularly those comparable in range and size, highlighting effective completions and any kind of accreditations or honors received. This strategy offers an alternative sight of your firm's strategy to job implementation.

Ensure that your organization licenses and enrollments are updated and readily available. Having actually these documents organized not just quickens the application procedure however likewise forecasts an expert image, instilling confidence in prospective guaranty providers and task proprietors - Bid Bonds. By methodically preparing these aspects, you place your company favorably for effective quote bond applications

Discovering a Guaranty Supplier

A surety company acquainted with your area will certainly better comprehend the distinct risks and requirements associated with your jobs. It is also suggested to examine their economic ratings from agencies like A.M. Ideal or Standard & Poor's, click to find out more ensuring they have the economic strength to back their bonds.

Engage with numerous suppliers to compare solutions, rates, and terms. An affordable evaluation will assist you safeguard the most effective terms for your quote bond. Eventually, an extensive vetting process will make certain a trustworthy partnership, promoting self-confidence in your quotes and future jobs.

Submitting the Application

Submitting the application for a proposal bond is a crucial step that needs meticulous attention to information. This process starts by collecting all relevant documents, including economic statements, project specs, and an in-depth organization history. Making certain the accuracy and completeness of these files is paramount, as any kind of discrepancies can bring about beings rejected or hold-ups.

When completing the application, it is recommended to double-check all entrances for accuracy. This includes validating numbers, ensuring correct trademarks, and verifying that all needed accessories are consisted of. Any type of noninclusions or errors check it out can weaken your application, causing unnecessary complications.

Leveraging Your Bid Bond

Leveraging your proposal bond properly can considerably enhance your competitive edge in protecting contracts. A proposal bond not only demonstrates your economic security yet additionally reassures the job owner of your commitment to fulfilling the agreement terms. By showcasing your bid bond, you can underscore your firm's reliability and credibility, making your proposal stick out amongst numerous rivals.

To leverage your proposal bond to its max possibility, guarantee it exists as component of a thorough quote plan. Highlight the strength of your guaranty provider, as this mirrors your firm's financial wellness and operational capability. In addition, visite site stressing your track record of successfully completed jobs can additionally instill confidence in the task proprietor.

Furthermore, keeping close interaction with your surety copyright can facilitate much better terms and conditions in future bonds, thus reinforcing your affordable placing. An aggressive approach to handling and restoring your proposal bonds can additionally avoid gaps and make sure continuous coverage, which is vital for continuous task purchase initiatives.

Verdict

Successfully getting and using quote bonds requires extensive prep work and tactical implementation. By comprehensively organizing essential documents, picking a credible surety provider, and sending a full application, companies can protect the essential proposal bonds to improve their competitiveness.

Determining a reputable surety company is an important action in securing a bid bond. A bid bond not only shows your economic stability but also assures the job proprietor of your commitment to fulfilling the contract terms. Bid Bonds. By showcasing your proposal bond, you can underscore your firm's dependability and trustworthiness, making your proposal stand out amongst various competitors

To leverage your proposal bond to its maximum possibility, guarantee it is provided as part of a thorough proposal plan. By comprehensively arranging key documents, selecting a credible surety provider, and submitting a full application, firms can protect the necessary bid bonds to boost their competition.

Report this page